True North Mortgage

truenorthmortgage.ca › home › tools › land transfer tax calculator

Land Transfer Tax Calculator (2026) | Rates from 2.49%

1 week ago - These taxes or title fees usually range from 0.5% to 3% of the total value of the home. Many provinces have multi-tiered taxation systems that can prove complicated, with different percentages charged as the home price climbs.

Videos

WHEN DO YOU PAY THE LAND TRANSFER TAX?

You must pay the Ontario Land Transfer Tax at the time of closing, which is the point at which ownership of the property officially transfers from the seller to the buyer. Again, you must pay this before registering the title transfer with the province.

chrisallard.ca

chrisallard.ca › home › mortgage resources › ontario land transfer tax calculator

Land Transfer Tax Calculator Ontario 2023 | Chris Allard

HOW MUCH IS THE LAND TRANSFER TAX IN ONTARIO?

This depends on the purchase price. Different marginal tax rates apply to specified portions of the property’s value. The more expensive the real estate, the more tax you’ll pay. Refer to the “How Ontario Land Transfer Tax is Calculated” section for details on tax rates.

chrisallard.ca

chrisallard.ca › home › mortgage resources › ontario land transfer tax calculator

Land Transfer Tax Calculator Ontario 2023 | Chris Allard

CAN THE LAND TRANSFER TAX BE INCLUDED IN A MORTGAGE?

You can’t include the land transfer tax in your mortgage when purchasing a property. This tax is considered a separate, one-time expense that must be paid in full at the time of closing.

chrisallard.ca

chrisallard.ca › home › mortgage resources › ontario land transfer tax calculator

Land Transfer Tax Calculator Ontario 2023 | Chris Allard

NerdWallet

nerdwallet.com › back to nerdwallet homepage › mortgages › canada land transfer tax calculator

Canada Land Transfer Tax Calculator - NerdWallet Canada

This means your one-time land transfer tax bill can add up to hundreds or even thousands of dollars. LTT is one of many closing costs you’ll need to account for when buying a home. Using our calculator to estimate the taxes or fees you’d pay on a purchase so you're prepared for your upcoming purchase.

Chris Allard

chrisallard.ca › home › mortgage resources › ontario land transfer tax calculator

Land Transfer Tax Calculator Ontario 2023 | Chris Allard

August 8, 2024 - Calculate your estimated Land Transfer Tax for buying a home in Ontario with our easy-to-use online calculator. Stay informed and budget accordingly:

First American

firstam.com › title › resources › calculators › title-fee-calculator.html

Title Fee Calculator | First American

First American’s Title Fee Calculator provides a comprehensive estimate for various property and transaction types across the nation. Please contact your local First American office or agent if you need any assistance or to confirm your quote.

Province of British Columbia

www2.gov.bc.ca › gov › content › taxes › property-taxes › property-transfer-tax

Property transfer tax - Province of British Columbia

If the parcels are transferred in multiple transactions, the registration date for all the parcels is considered to be the date on which the first application for registration is filed in the land title office. ... Use our online calculator to estimate the property transfer tax amount you may owe.

Landtransfertaxcalculator

landtransfertaxcalculator.ca › home

Land Transfer Tax Calculator

April 11, 2025 - Buying or selling a home in Ontario? This website is a quick reference and land transfer tax calculator for real estate consumers.

Worldwidelandtransfer

worldwidelandtransfer.com › home › tools › title fee and closing cost calculator

Title Fee and Closing Cost Calculator | World Wide Land Transfer

August 13, 2024 - Check out our Title Fee and Closing Cost Calculator page. Contact us for more information.

Ratehub

ratehub.ca › land-transfer-tax-ontario

Ontario Land Transfer Tax Rates 2026 | Calculator | Ratehub.ca

2 weeks ago - When you a buy a house or condo in Ontario you are subject to land transfer tax on closing. Use Ratehub.ca’s calculator to determine your land transfer tax or view Ontario’s current rates below.

State of Michigan

michigan.gov › sos › all-services › title-transfer-and-vehicle-registration

Title transfer and vehicle registration

You may contact our Information Center at 1-888-SOS-MICH (1-888-767-6424) and someone will help you figure the fee for your particular vehicle, or visit a Secretary of State branch office for assistance. Use the registration fee calculator to calculate your vehicle registration fee. Use the plate transfer fee calculator to calculate the cost of transferring a license plate. ... You have 15 days to transfer the title after the date of the sale.

LTSA

ltsa.ca › home › fees

Fees - LTSA

October 20, 2025 - 1Listed administrative fees do not include applicable taxes 2Fee only applies to requests processed by LTSA employees 3Consist of Land Title records that are not available through an LTSA account, or Surveyor General records

Tridentland

tridentland.com › home › title rate calculator

Title Rate Calculator - Trident Land Transfer Company

September 29, 2023 - All Calculations are saved and should be verified by the Title Agent to ensure the validity of the input criteria with the calculation. Accordingly, MyTitleRates.com will not be held liable for any use of these calculations in your particular real estate transaction. Trident Land Transfer Company ...

CA

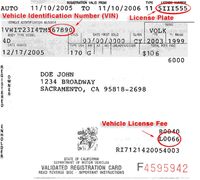

dmv.ca.gov › vehicle registration › registration fees › vehicle registration & licensing fee calculators

Vehicle Registration & Licensing Fee Calculators - California DMV

March 10, 2020 - This online service allows customers to calculate estimates of various registration and licensing fees. ... Fees vary depending on your actual vehicle registration transaction. For example, if the purchase price keyed by the customer differs from what is ultimately entered on the title and submitted to DMV, the vehicle registration fees may change when the vehicle is registered.

Kahane Law Office

kahanelaw.com › home

Transferring Land Title In Alberta Costs/Fees: Changing Names On Title

April 8, 2024 - The cost of transferring land title in Alberta is set by the Land Titles Act and charged by the Alberta Land Titles Office. People also refer to transferring a name on title as changing names on title. It is also called property name transfers. This process is not about if you have changed your name and just need to update your name on title.

DMV New York

process.dmv.ny.gov › regfeecalc

Ny

An official website of New York State · Official websites use ny.gov

Moderntitlegroup

moderntitlegroup.com › calculator › transfer

Modern Title - Transfer Calculator

Click here for more information on county transfer tax · NOTE: This tool is intended to be used for illustrative purposes only. Estimates are not guaranteed and may be different based on your individual situation. Modern Title Group does not provide tax or legal advice.

Reddit

reddit.com › r/askcarguys › how much should a car title transfer cost?

r/askcarguys on Reddit: How much should a car title transfer cost?

August 28, 2024 -

I’m about to buy a car but I need the tittle transferred to me my ppl said it would cost around $300 dose that sound right? I live in Texas btw.

Top answer 1 of 7

2

Texas title transfer cost According to the search results, the title transfer fee in Texas is $33, which is charged by the state to transfer the title of the car to the new owner. Additionally, there may be other fees associated with the title transfer process, including: Vehicle Inspection: This fee can vary depending on the location, but typically ranges from $20 to $40. Dealer documentation fee: This fee varies by dealership and can range from $0 to several hundred dollars. Registration fee: This fee also varies by location and can range from $0 to several hundred dollars. It’s essential to note that these fees may not be included in the initial title transfer fee of $33. It’s recommended to check with your local county tax office or dealership for a detailed breakdown of the costs involved in transferring a title in Texas. Important: Be aware that if you miss the 30-day deadline (or 60 days for active duty military personnel) to apply for title and registration, you may be subject to financial penalties, which can reach up to $250.

2 of 7

1

If you need a title transfer and new plates to go with it, it could be from $300-$500 depending on what State I don’t know how much Texas charges. Illinois it’s 350.